Stonewell Bookkeeping Can Be Fun For Everyone

Wiki Article

Not known Facts About Stonewell Bookkeeping

Table of Contents10 Easy Facts About Stonewell Bookkeeping ShownThe Buzz on Stonewell BookkeepingSome Known Factual Statements About Stonewell Bookkeeping Some Known Facts About Stonewell Bookkeeping.The Stonewell Bookkeeping PDFs

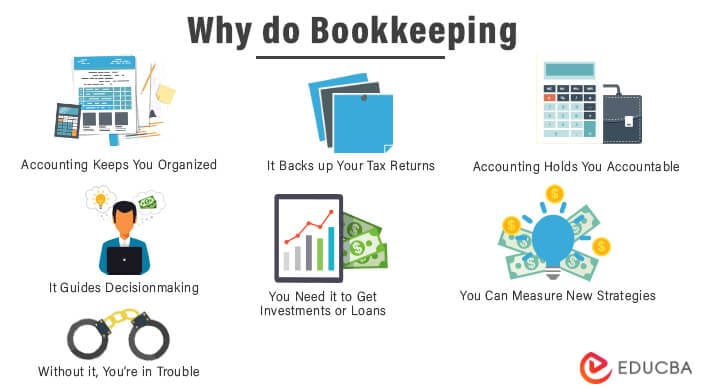

Here, we answer the question, how does accounting aid a service? In a feeling, accountancy books represent a snapshot in time, but just if they are upgraded commonly.

None of these verdicts are made in a vacuum as valid numeric info should buttress the economic decisions of every small organization. Such information is put together via bookkeeping.

Still, with proper capital administration, when your publications and journals are up to day and integrated, there are far less enigma over which to worry. You recognize the funds that are offered and where they fall short. The information is not constantly excellent, yet at least you recognize it.

The Buzz on Stonewell Bookkeeping

The maze of deductions, credit scores, exceptions, routines, and, of course, charges, is enough to simply give up to the IRS, without a body of efficient paperwork to support your insurance claims. This is why a devoted accountant is invaluable to a local business and deserves his or her weight in gold.

Your organization return makes claims and depictions and the audit focuses on validating them (https://www.bunity.com/stonewell-bookkeeping). Great accounting is everything about linking the dots between those depictions and reality (best franchises to own). When auditors can adhere to the details on a ledger to receipts, financial institution declarations, and pay stubs, to name a couple of records, they rapidly discover of the expertise and integrity of the service organization

Stonewell Bookkeeping Can Be Fun For Anyone

Similarly, slipshod accounting adds to stress and stress and anxiety, it also blinds business proprietor's to the potential they can understand in the future. Without the information to see where you are, you are hard-pressed to set a destination. Just with understandable, thorough, and accurate information can a company owner or management team plot a training course for future success.Company owner recognize ideal whether a bookkeeper, accountant, or both, is the ideal solution. Both make important contributions to an organization, though they are not the exact same occupation. Whereas an accountant can gather and organize the information needed to sustain tax obligation preparation, an accounting professional is much better fit to prepare the return itself and actually analyze the income statement.

This article will dive right into the, including the and how it can profit your organization. We'll additionally cover exactly how to get going with accounting for an audio monetary footing. Accounting includes recording and organizing economic deals, including sales, purchases, settlements, and receipts. It is the process of maintaining clear and concise records to make sure that all economic info is conveniently obtainable when needed.

This article will dive right into the, including the and how it can profit your organization. We'll additionally cover exactly how to get going with accounting for an audio monetary footing. Accounting includes recording and organizing economic deals, including sales, purchases, settlements, and receipts. It is the process of maintaining clear and concise records to make sure that all economic info is conveniently obtainable when needed.By regularly upgrading financial documents, bookkeeping aids companies. Having all the economic info conveniently available maintains the tax authorities completely satisfied and avoids any type of final migraine throughout tax filings. Routine accounting ensures properly maintained and orderly documents - https://www.goodreads.com/user/show/196265252-stonewell-bookkeeping. This helps in easily r and saves businesses from the tension of browsing for visit the site files during deadlines (Bookkeeping).

8 Simple Techniques For Stonewell Bookkeeping

They are mainly worried regarding whether their cash has been utilized properly or otherwise. They certainly would like to know if the business is earning money or not. They additionally would like to know what possibility business has. These facets can be easily taken care of with accounting. The profit and loss declaration, which is ready on a regular basis, reveals the profits and likewise determines the prospective based upon the revenue.By maintaining a close eye on financial documents, businesses can set realistic goals and track their progress. Regular accounting makes sure that businesses stay compliant and avoid any penalties or legal concerns.

Single-entry bookkeeping is easy and works best for small services with few purchases. It includes. This technique can be contrasted to preserving a straightforward checkbook. However, it does not track assets and liabilities, making it less thorough contrasted to double-entry accounting. Double-entry accounting, on the various other hand, is more innovative and is generally taken into consideration the.

The smart Trick of Stonewell Bookkeeping That Nobody is Discussing

This can be daily, weekly, or monthly, depending on your service's size and the quantity of deals. Don't wait to look for help from an accounting professional or bookkeeper if you discover managing your monetary documents challenging. If you are looking for a free walkthrough with the Bookkeeping Service by KPI, contact us today.Report this wiki page